So you’ve been tossing around the idea of investing in rental property…

But you’ve got no idea where to get started.

You need a rental property business plan.

I’m Ippei, and I’ve been killing it at online business, passive income, and local lead generation since 2014.

And I’m here to guide you through a simple 7 step rental property business plan to help you get started on your investing goals today.

So let’s get right into it!

Rental Property Business Plan in 2025

Considering Starting a Rental Property Business in 2025? You Should Know This First:

Investing in real estate rental properties can be extremely rewarding and profitable. But to get started, you will need to write out your business plan, get your business legal, choose the right area and property, and crunch the numbers. Plus obtain sufficient financing and prepare to remodel your rental properties!

Start Up Costs

While this list is not a comprehensive compilation of everything you need to start a rental property business, it provides a snapshot of what you need to add into your business plan.

Annual Revenue of Established Rental Property Business

According to Forbes, the average annual revenue of this kind of business is: $4,800 per property

Profit Margins of Established Rental Property Business

According to MySmartMove, the average Profit margin of this kind of business is: 2%

7 Step Rental Business Plan Checklist:

1. Actually Write a Business Plan

Surprise, surprise…

My very first tip for your killer rental property business plan is to actually write down your business plan!

It’s easy to get overwhelmed by the thought of creating a formal business plan…

But that’s not what is necessarily needed here.

In fact, it’s best to keep it simple.

Write it down on paper, not in your Google docs or in an app on your phone.

You can do this later, but right now the goal is to physically write out your rental business goals.

Focus on your long term vision.

You want to give yourself a sizable goal to work towards, but if you paint an unrealistic picture of success for yourself with an equally unrealistic timeline attached…

You’re going to get burnt out and frustrated.

Aim big, but also remain a realist.

Post this written business plan (it doesn’t have to be long) in a place that’s consistently visible to you, so that you are regularly reminded of your goals.

The entire purpose of a business plan is something that you can refer back to regularly, and use actively.

When writing your business plan, break your long term vision down into smaller, bite sized, actionable steps.

If you’re unsure of where to get started, here is a simple outline for you to follow!

Basic Things to Include in a Business Plan:

2. Get Everything Nice N’ Legal

While there are a lot of fantastic tax breaks for real estate investment owners…

(Hello tax write off for that rental property remodel!)

You are still going to be expected to pay taxes just like any other business owner.

Which means that now is the time to get your rental property business legally in order.

I highly recommend that you take steps to legalize your business from the beginning, rather than waiting until your first round of business taxes are due!

So go ahead and get that business license, and register for your business entity structure.

If you have a partnership, then registering your business as a Partnership is the (obvious) best choice for you.

But if you’re going this real estate rental business on your own, then a Limited Liability Corporation is probably your best bet.

If you are unsure of which business structure is the right choice for you, always consult an attorney for outside input.

An LLC is great for most business owners because it allows you to separate your personal assets from your business.

So if your business is ever sued, you and your personal belongings are safe.

Plus, you never want to do business in real estate under your own name.

Everything should be owned under your business.

This is further personal protection for you from a legal standpoint.

Once you have your LLC (or other applicable entity), then it’s time to apply for your EIN number.

An EIN number is your tax ID number, and you will need it for…

Yep, you guessed it: filing your taxes.

But also for hiring any future employees, and opening a business bank account.

The process is simple, and you can easily apply online for free via the IRS website.

And last but not least, you cannot forget your insurance!

There is so much risk involved when you are renting out a home, which is why having a solid, full coverage insurance policy is so important.

Look into the following types of coverage to determine what is right for your rental property business:

3. Choose the Right Location/Area

Invest where the numbers make sense based on the strategy you’ve chosen.

This means that it isn’t mandatory to invest in your current neighborhood or local area.

It can make things simpler if you are able to physical drive to your rental properties, but it isn’t a requirement.

Follow the research and the numbers, and let that guide your decision on where to start investing in your rental properties.

Look at at least ten properties before you make an offer on one. Walk through the neighborhood, get a feel for the area that you are going to be investing your hard earned money into.

Look out for boarded up windows, condemned homes, poor landscaping, and other such red flags that might be a turn off for potential renters.

You should look closely at these three factors when choosing the right location and property to invest in:

That last one is really important.

Why?

Because some cities are more renter friendly, and some cities are more landlord friendly.

If you are purchasing an investment property…

You want to be confident that you are in a landlord friendly area that will allow you to enforce your own rental policies and evict poor renters when absolutely necessary.

4. Crunch the Numbers

I’m not just talking about how you’re going to get the money that you need to start investing!

It won’t matter how much money you have access to…

If you haven’t crunched the numbers to find out what will actually create a profitable and sustainable rental business in the first place.

Personally, I recommend erring on the side of caution when it comes to estimating your rental finances.

What I mean by this is that when you crunch the numbers to determine your profit margins…

It's better to be conservative.

Then, if you make more money than you were expecting…

Awesome!

But you minimize the risk of going into things with an overly optimistic view of your projected income and profit…

And then walking away with less than you originally thought.

So what do you need to be thinking about when calculating your rental property profits?

Here are the basic expenses that need to be accounted for in a simple equation:

First, find your projected rent for the property you’ve purchased.

Then, subtract the following expenses from your projected rent:

And this will equal your net income!

Now, depending on how much you bought the property for, how much you’ve invested in remodeling, and whether you purchased your rental property in cash or via financing…

Will ultimately determine what your return on investment percentage will be.

For rental properties that have been financed, you’re probably looking at only a 3-5% return on investment.

But for properties that have purchased up front with cash, you can expect at least a 6-8% return on your investment after all your monthly and annual expenses are taken out!

When choosing the rental property that you want to invest in, always run these numbers for yourself before committing to the purchase!

Oftentimes, real estate agents will put together a profit proposal on your behalf…

But they are usually overly optimistic, and can set you up with unrealistic expectations.

At the end of the day, you are the one responsible for getting a solid return on your investment…

So take the time to crunch the numbers yourself, rather than relying on someone else.

5. Find the Right Property and Negotiate

Choosing the right area to invest in real estate properties is really only the beginning of making a wise investment in a rental property.

Finding the right property itself is even more important than the area you are buying in…

Though the two are obviously interconnected.

Because the goal of purchasing a rental property is to generate a profit…

You aren’t going to be choosing a home based off of the same criteria that you would if it were going to be your own personal residence.

Finding a “steal of a deal” so to speak, is the ultimate goal.

Which generally means that you are going to be looking for properties that are more run down or aesthetically lacking.

These properties are usually referred to as “distressed properties” in the real estate world.

The goal here is to purchase a home that most other people aren’t going to go for.

Which gives you negotiating power with the seller.

But you don’t want to buy too much of a dump, because you will need to be able to remodel and update it relatively quickly to put it up for rent.

There is a sweet spot with investing in rental properties where most of the problems are cosmetic.

Easy fixes for you as the landlord, but turn offs for typical buyers.

Don’t be afraid to take your time, and always ask for a due diligence period when going under contract on a potential rental home investment.

During the due diligence period, you will be able to hire a private inspector who you trust who will thoroughly evaluate your property for damage and issues.

At this point in the process, you can also bring in the city to do the official city inspection.

Not only is there a chance that they might spot something your private inspector missed, but you should contact them at this stage anyways…

Since you will need to register your property with the city as a rental property so that you can receive your rental property license.

After you’ve fully evaluated the renovations that the property will need based on both inspections…

You can use this information to negotiate the best price possible with the seller.

And as a final tip…

Don’t be an overly emotional investor (with real estate or the stock market for that matter!)

Carefully evaluate the market, and look for potential.

A trashy area now might be in the beginning stages of revitalization and the appreciation will be astronomical in ten years or less.

6. Getting Financing

Getting into rental property investing takes money.

There’s no question about that.

Yes, there are slightly sketchy ways to get around this…

But at the end of the day, it’s going to take a significant investment.

If you are able to purchase your first rental property (or more) in cash, that is absolutely the best way to go.

However, for many people, this simply isn’t attainable at first.

If this is the case for you, then you will need to be prepared to seek outside funding.

There are multiple ways to do this.

The most common is simply to go through your bank or mortgage company of choice.

Should you choose this route, you will need to be prepared to meet their expectations and prove that you are a worthwhile and low risk investment for them.

Your bank will probably evaluate at least the past two years of your income to determine whether or not your finances are stable enough to qualify for a loan…

And they will also want to look at your credit score.

This is a big one.

For the best rates, you really need at least a 760 credit score.

Which is considered excellent!

If your credit score isn’t anywhere close to this right now…

Don’t panic.

There are steps you can take to get your credit up to par before beginning your rental property investment journey.

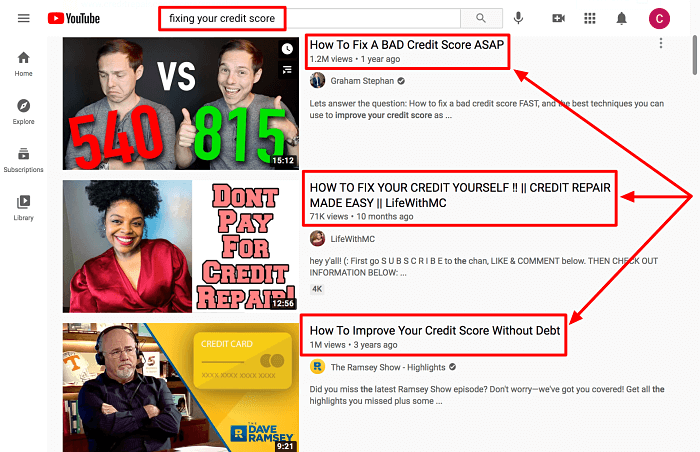

(Youtube is a great resource for free information on improving your credit score!)

Typically, the bank is also going to be interested in your prior business, property management, and investment experience.

While having prior experience is always helpful…

Everyone has to start somewhere, and your bank knows this.

So prior experience isn’t a deal breaker.

Outside of traditional lending options, you can also consider going into business with a partner or two.

You will put in an equal amount of money up front, and split your profits equally as well.

This is a great option if you have some significant funds to invest up front, but just not enough to purchase the entire property in cash.

And if you prefer to avoid borrowing from a bank, or you simply can’t qualify…

Consider reaching out to friends or family for a private loan.

Just make sure that you get everything in writing and under a signed contract…

Borrowing money from friends or family members can get messy quickly!

7. Remodeling Your Rental Properties

Many times, the best deal for rental properties won’t be the cutest or most updated houses.

Which leaves you to get your rental investments into tip-top shape before putting them up for rent!

And since you’re in this for a profit, everything needs to be done on a budget.

So you’re going to be looking for affordable yet durable upgrades that will make the largest impact from your renter’s perspective.

The best renovations for your money will always be in the kitchen and the bathrooms.

Consider upgrading the appliances, because something this simple can make a huge difference for your renters!

Think about it, they are going to be using the stove, refrigerator, dishwasher, and laundry areas on a daily basis.

Having some new stainless steel appliances, versus the grungy old appliances that came with the property, can make such a huge difference in their day to day lives.

Another fantastic change to make if you have the money left is to update the flooring.

Go ahead and replace that grimy old carpet with some affordable but functional vinyl plank flooring…

And the whole place is going to feel different instantly.

The same goes for the paint on the walls.

Sometimes, a run down house is being held back by simple things.

Like needing a good deep cleaning, some updating flooring, and a fresh coat of paint!

Before you know it, everything starts to feel like new with some simple and affordable updates that will have your renters feeling like they’re truly at home

Which is ultimately what you want!

So many landlords and real estate investors simply don’t care about their renters.

They just want to make their monthly passive income and move on…

Regardless of the experience or needs of their renters.

But putting your tenants first will ensure that they stick around for a long time.

And if you need any help finding those tenants...

Take a look at our local lead generation program for small business owners (or real estate investors!).

Plus, when you respect people, the favor is often returned!

If you want people to care for and respect your investment property, then you first need to care for and respect them.

Pros and Cons

of starting a rental property business

Pros

The beauty of owning rental property is that it generates relatively passive income every single month! For most people, this is the greatest appeal to investing their money into rental real estate. And for good reason. Once you accumulate a handful of solid rental properties… You can theoretically afford to quit your day job! Or at the very least, make a huge impact on your long term financial situation.

If having a steady stream of passive income every month isn’t a sweet enough deal… A wisely chosen rental property will also appreciate in value over time. So even if you decide to sell the property in the future, you’ll get a nice return on your initial investment.

It’s no secret that investing in rental real estate has the major perk of major tax breaks. That’s right… If you hadn’t heard this already, owning real estate gives you access to all sorts of tax write-offs at the end of the year. Everything from deferring your capital gains, to writing off property taxes and operations expenses.

Cons

A long standing belief is that most people take better care of a home that they actually own, than one that they are just renting. For this reason, and many others, dealing with rental tenants can be a pain in the ass. Whether it’s damage to the property, secret pets, or illegal activity… Handling tenants is a lot of work. And even if you have a property manager to take the brunt of this workload… You will still need to be informed, involved, and on top of things as the property owner.

Many people hear the word “passive income”, and immediately start fantasizing about lounging on a beach in Bali while money continues to flood into their bank account every month. While this is definitely a part of making steady passive income (if the beach bum life is your goal)... Owning rental properties is still a lot of hard work! Especially up front. You have to do your due diligence to find the right property, and put in a lot of hard work to get it ready to rent out. And the hard work doesn’t end there. You will need to deal with your tenants, and be prepared to put in more work every time there is a renter turnover to prepare the property for its new tenant.

Finding a great deal on property isn’t always possible. Making a wise investment on a future rental property is extremely dependent upon the market as a whole. Just because you’re ready to buy today, doesn’t mean that the right property at the right price is going to be available.

A Rental Property Business Can Work, but Lead Gen is Better... Here's Why:

Setting up a solid plan of action for your rental property business is just the beginning of what it will take to get started in real estate investing.

It’s easy to paint a straightforward picture of success on paper, only to get out into the real world and realize how much harder it actually is.

Investing in rental properties can be extremely lucrative, but you should be prepared that this business model is not for the faint of heart.

You need to be comfortable with a reasonable amount of risk, and ready to put in the due diligence work up front to find the right property.

Being patient can be the difference between striking gold, and losing money on an investment property.

But ultimately, becoming successful in the rental property business takes hard work, and extensive finances.

It will take time before it turns into passive income, and even then, you will still need to be actively involved in the maintenance of your rental properties…

Even if you hire a property manager.

Personally, if I were going to recommend a business model for sustainable passive income…

It ultimately wouldn’t be rental properties.

You see, when I quit my job over six years ago to pursue financial freedom and entrepreneurship, I dabbled in everything from drop shipping to affiliate marketing…

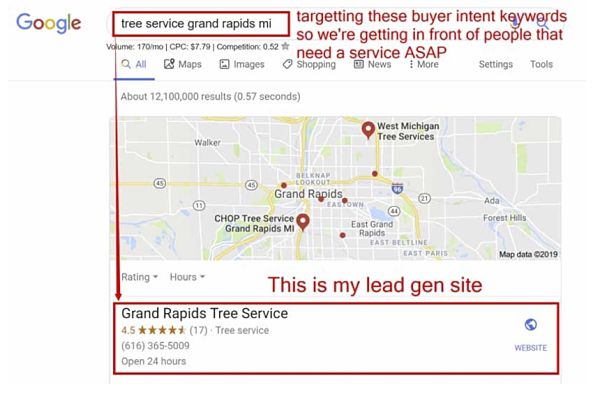

But what changed everything for me was when I found local lead generation.

Local Lead generation is like having online real estate, where every lead gen property that you have generates monthly passive income.

The online lead generation business model took me from barely being able to pay my bills…

To making over 50K per month in less than five years.

All while being able to help other small business owners by supplying them this a steady stream of new leads.

So if you love the idea of having passive income through rental property, but don’t have the up front capital or the time to manage it all…

Click here to learn more about how we can help you get started with local lead generation instead.