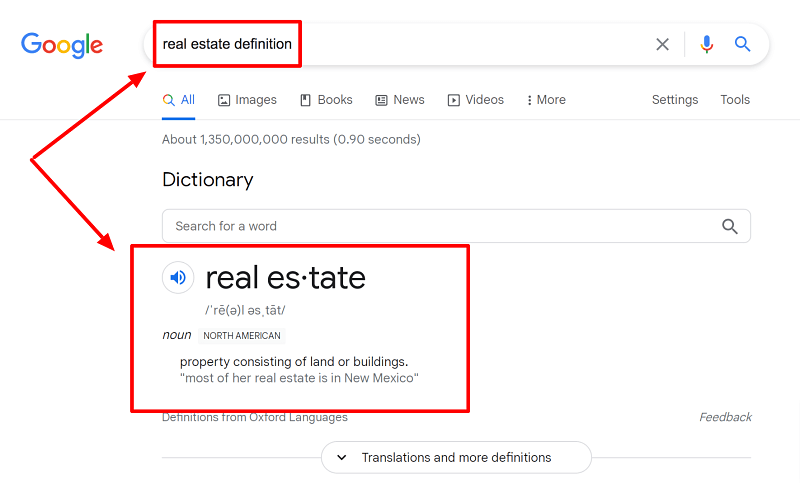

Investing in real estate has roots that trace all the way back to the Louisiana purchase in the early 1800’s…

And I think it's safe to say that this business model isn’t going anywhere.

In fact, real estate has been considered one of the safest and most lucrative methods for passive income for years as the appreciation rate has historically only gone up…

Even despite the infamous 2008 recession!

But how can you get started with a real estate investing business in 2026?

And can it be done with little to no money, or do you need to be wealthy from the get go?

I’m Ippei, a master of all things passive income, online business, and primarily: local lead generation.

In this article, I’m going to answer the above questions and many more in my 7 step guide to starting a real estate business.

Plus, I’m including the realistic startup costs for this industry, and the average profit margins that you can plan for.

Let’s dive right in, shall we?

How to Start a Real Estate Business in 2026

Considering Starting a Real Estate Investing Business? Here's What You Should Know:

Starting a real estate business requires a lot of hard work up front before you ever get to passive income. To get started, you will need to write a solid business plan, get your business license, choose a real estate niche, and secure your funding and finances.

Start Up Costs

While this list is not a comprehensive compilation of every you need to start a real estate business, it provides a snapshot of what you need to add into your business plan.

Low:

High:

Pre-licensing Education

Certification:

$300+

Testing Fees

$50/yr

$300/yr

Continuing Education:

$7,000

$30,000

Professional Development + Conferences:

$300+

MLS Fees:

$20/month

$50/month

Errors + Omissions insurance:

$55/mo

$665/yr

Association Fees:

$200+/yr

Self-Employment Income Taxes:

15.3% of net income

Health Insurance:

$393/mo

Office Supplies:

$27/mo per employee

$92/mo per employee

Marketing Materials:

$1,000+/yr

Technology Products + Services:

$848/yr

$1,410/yr

Internet/Phone Service:

$35/mo

$165/mo

Broker Costs + Desk Fees:

$25 per month

$500 per month

Total Cost to Start Up:

$5,000

$3,500

$10,000+

Annual Revenue of Established Plumbing Business

According to MillionAcres.com, the average annual revenue of this kind of business is: $70,000-$124,000

Annual Profits of Established Plumbing Business

According to Forbes.com, the average Profits of this kind of business are: $41,289

Profit Margins of Established Plumbing Business

According to smallbusiness.chron.com, the average Profit margin of this kind of business is: 14.80%

7 Step Quick Start Checklist:

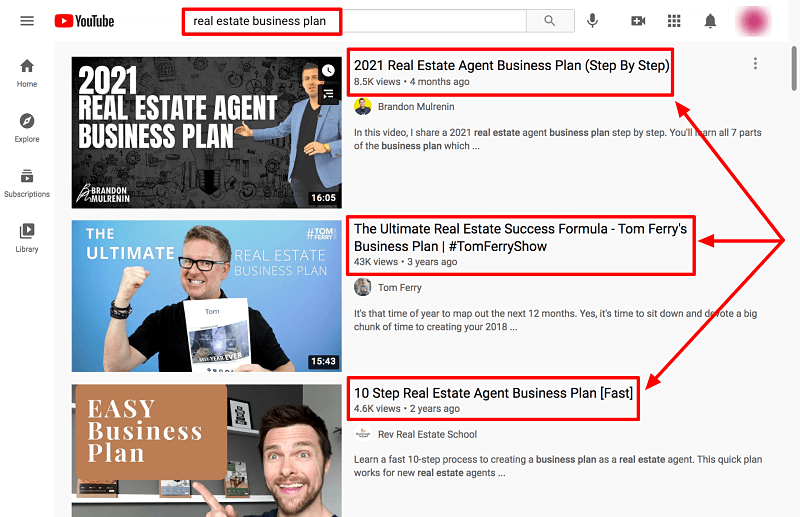

1. Write a Business Plan

Listen, it’s no secret that investing in real estate can put you on the road to wealth.

But oftentimes, the distinct difference between those who desire wealth and those who actually attain it…

Is the amount of planning and strategy that goes into building wealth.

And that goes for any business model, honestly!

So if you want to make it big with your real estate business, you’re going to need a business plan.

Especially since many real estate businesses rely on outside investors or loans…

In which case, your potential partner, investor, or bank is going to want to see your well laid plans in a written and professional form!

To get you started, here is a simple business plan outline that can guide you through the basic framework of writing a professional business plan:

Basic Things to Include in a Business Plan:

Another huge benefit that comes from sitting down and fleshing out a solid business plan from start to finish…

Is that the act of writing itself will solidify your goals in your own mind.

If the idea of venturing into real estate investment is slightly intimidating to you…

Your business plan will help give you confidence, and remind you of your goals, and systems you will use to get there!

2. Get a Business License

As a real estate professional, a business license is going to be a non negotiable step for you.

Yes, you could probably wing it as a Sole Proprietorship for a while (which is the entity structure that you will automatically fall into)...

But if you are serious about the real estate industry and committed to real estate investing as a business, then you need to get your business license.

The first step is to simply choose a name for your business.

This might sound easy, and to some degree it is…

But you need to watch out for two things when selecting a name for your real estate business:

The first one is important because you don’t want to run any legal risks by assuming a name that is already in use.

Plus it can be confusing and bad for your business as a whole when people don’t know which business is which.

And yes, there are words that you actually need to avoid using in your business name as a real estate investor!

Try to stay away from using the words real estate in your business name.

I know, I know, you probably think I’m crazy right now.

Real estate is your thing, right?

But real estate is known as a high risk business, and therefore a high risk investment.

Which may make it more difficult for you to gain investors or loans in the future if the words “real estate” are included in your business name.

Instead, opt for words like:

Next, you will need to choose the right business structure for the business you are building.

With this step, it can be helpful to include the expertise of a lawyer/attorney.

But typically, most real estate professionals find that a Limited Liability Corporation is more than sufficient for their needs when first starting out.

Depending on your specific goals, and the scale of business you are trying to grow, consider consulting a lawyer during this phase if you are unsure that an LLC will meet your needs.

The primary benefit of structuring your business as an LLC is that an LLC protects you and your personal assets in the case of a lawsuit…

Or God forbid, if your business just straight-up fails and goes under.

3. Consider Getting a Real Estate License

While it isn’t 100% necessary to obtain a real estate license to get into the real estate investing business…

It can be helpful in a variety of ways.

The important thing is that you thoroughly weigh the pros and cons before you make a decision.

Just remember that it is possible to find success in real estate with or without a real estate agent license!

As far as the pros for obtaining your real estate license goes…

You will definitely have a greater income potential because you won’t be dishing out 6-8% of the sales price of a property in commission fees!

Plus, you will have direct access to the Multiple Listing Service real estate platform (better known as the MLS).

Another benefit to keep in mind is that networking is a massive part of finding success in the real estate business….

And becoming a licensed real estate agent will grant you access to a vast network of other real estate professionals.

If you are the type of person who likes to have complete control, then becoming a licensed real estate agent might also be a good move for you…

Since this essentially gives you total control over the entire negotiations process.

It can also add to your credibility, which can really help when you are first starting out!

However, there are still some downsides that you should take into account before jumping into the process.

Which is actually my first point:

The process is a time consuming and intensive commitment.

Typically, you can expect to spend 60-90 hours on formal education and then studying for your licensing exam.

This is usually at least a 3-6 month process.

I’m going to assume that if you are interested in real estate, you are aware that it will cost you to get your foot in the door.

And this principle holds true for obtaining your realtor’s license.

The expense usually ranges from $350 to $1,200 depending on your state…

Not including the yearly membership dues, monthly broker fees, marketing costs, and continued education, etc.

At the end of the day, being a real estate investor is hard work…

And adding the role of real estate agent to your list of responsibilities isn’t something to be taken lightly.

It will be more work for you overall, compared to partnering with a trained and trustworthy real estate agent and focusing your energy on income generating investments.

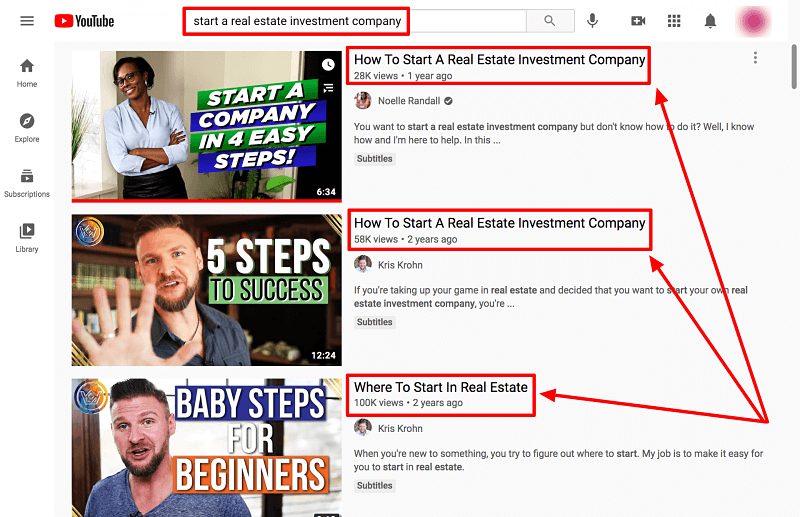

4. Find Your Real Estate Business Strategy

If you’re going to get serious about creating a thriving and profitable real estate business…

Then you need to specialize as quickly as possible.

There are so many different strategies for real estate investing, and you can workshop the ones that work for you over time…

But at the very least, you need to decide the basic real estate niche you are going to focus your energy on in the beginning.

Once your business is well established and thriving, then you can start to expand your investment niches.

Some of the basic real estate investment categories are:

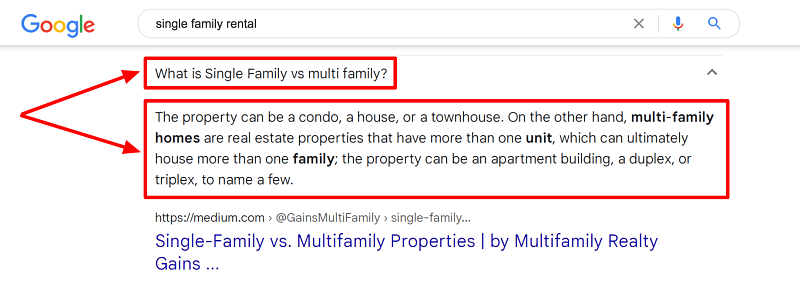

The lease to own model of investing is a great combination investment method.

Ultimately, the beauty of it is that you will receive a decent amount of money up front as a sort of “down payment” that you can use to build your investing capital…

And then you will be able to collect monthly rent (passive income) for a period of time until the point of final purchase arrives as per the agreed upon timeline in your contract.

A single family rental is one of the more common and attainable methods of real estate investing.

It’s success comes down to purchasing a home for a great deal, and then renting it out for more than the monthly mortgage.

Plus, if you are careful to choose a home in the right neighborhood with the right specifications…

If you ever choose to sell the property, you will be able to make a profit from that as well!

Multi-family rental properties are not for those “ballin’ on a budget” as the cool kids like to say.

You’re going to need a hefty investor, or a large amount of your own money to invest in a large apartment complex.

But, if you are capable of making this sizable of an investment…

I’d say that you are well on your way to real estate success.

Because multi-family rental investments are definitely big money makers!

Hello Chip and Jo!

Are you ready to live your dream as the next Fixer Upper?

Then the real estate investment model of flipping houses might just be for you.

While it does take some time and finances to flip a property to turn a huge profit…

The reward is a large chunk of money at the end of the sale that you can then re-invest into your next flip property (or two!).

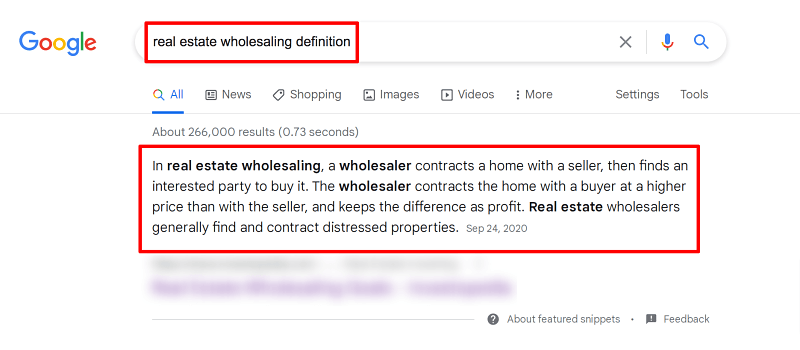

Finally, if you’ve ever heard the term, “real estate wholesaling before” but aren’t sure what that entails…

It’s definitely a method to look into.

Especially if you are trying to start a real estate business with no money.

That’s right, real estate wholesaling doesn’t actually require up-front cash.

Because all you are doing is connecting a seller with a buyer.

This method works best in situations where the home is in distress.

Let me explain...

For Example:

If someone has a home that they would love to sell, but they genuinely believe no one will want to buy it… You can come in and offer your services to find them the right buyer. You both agree on a fair price, let’s say $85,000. But then you find a buyer who is willing to pay $95,000! Your profit is the $10,000 difference.

5. Funding and Finances

Let’s talk money!

There are so many different ways to start the real estate investing process, whether you’re working with hundreds of thousands of dollars already…

Or hoping to get started with little to nothing.

One principle that is important to remember when beginning your real estate investing journey is that it isn’t necessarily your responsibility to possess all the resources…

Just to gather them.

Which is where finding investors comes into play.

Here are some viable financing and funding options to consider when starting out in the real estate business:

Financing Options:

If you are interested in getting started with little to no money as a real estate investor, then your options are much more limited.

But there are several paths to consider.

To start out, consider purchasing a home as your primary residence.

You might not make any money off of it immediately, but this is still considered a real estate investment that you can sell for a profit when you are ready.

Plus, a mortgage tends to be cheaper than renting!

So you can consider setting aside the difference to continue saving up for future real estate investments.

You could also opt for purchasing a duplex, which would allow you to live in one unit while renting out the other one.

Opening a Home Equity Lines of Credit (HELOC) on your current home or on an existing investment property is also an option.

Lastly, minimize the costs associated with purchasing a home by asking the seller to pay closing costs…

And utilize a lender that will either pay closing costs or offer you a rebate on your down payment amount.

6. Set Up Basic Contact Methods and Start Marketing

Before you can do much as a real estate investor, you’re going to need clear and professional contact methods in place.

At a minimum, you should have:

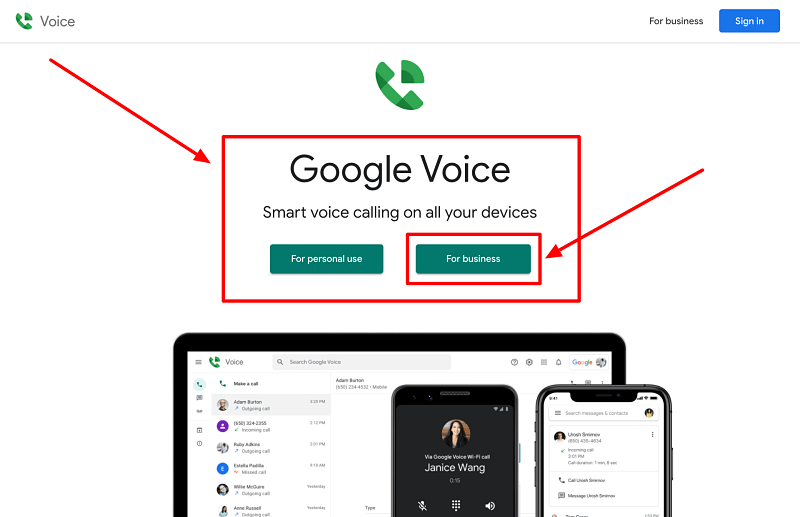

Fortunately, you can easily obtain a business phone number through Google for free!

But keep in mind that you cannot register a Google number with a directory…

So consider a monthly business number service like Grasshopper or Freedom voice.

These numbers will typically only cost you around $10-$20 per month.

Google also offers free business emails through their Gmail service…

But if you’ve already obtained a domain name for your website, you should look into obtaining a professional email with your website’s domain at the end.

For Example:

Trust me, if you want people to take you seriously in the real estate industry…

This is the way to go.

A Gmail email account will probably suffice, but you definitely don’t want to be handing out cards with your hotmail email address from high school!

Your website will be a crucial step in adding credibility to your business, but that doesn’t mean you need to drop thousands of dollars on a web designer.

Assuming that you’re still trying to keep your initial investments at a minimum…

There are some amazing template based website builders available now that make building a professional website extremely simple!

Some of my personal favorites are:

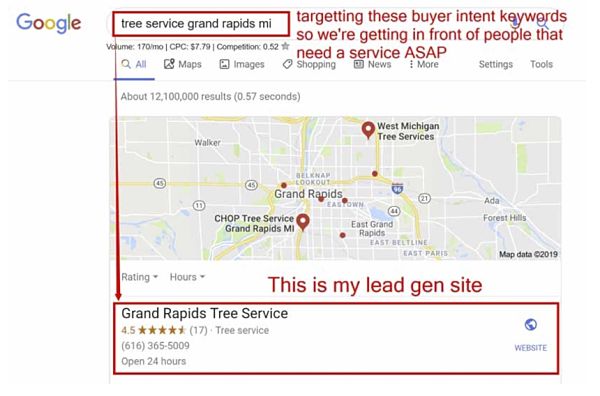

Once you have your site built out, you can move on to setting up a Google My Business account, which is completely free.

Having a GMB account for your business will greatly increase your online visibility, and make it easier for people to find you locally within Google search results and Google Maps.

While getting new leads for your real estate business can seem overwhelming, taking the step of creating a GMB account is a step in the right direction.

Generating leads for your business takes strategy, and luckily for you…

We happen to be pros at it.

In fact, we teach local business owners how to sustainably generate a steady stream of new leads online for their businesses…

Practically on auto pilot.

And we can do the same for your real estate business.

So if you want to learn more about how local lead generation can change the game for your business, click here for more information on how we can help you get started today.

Lead generation and marketing should really go hand in hand…

Which is where you should turn your attention to now that your methods of contact are ready and in place.

Start off by setting up business social media accounts across 2-3 platforms that you enjoy and can commit to staying active one.

You’ll be surprised at how much social media can change the marketing game for your business.

And from there you can look into:

7. Do Your Due Diligence

Investing in real estate takes time, strategy, and patience.

I cannot stress enough the importance of not rushing the process…

Wait for the right investment opportunities to come along, and do your due diligence in the meantime so that you will know what that “right” opportunity is when you see it.

Which means research, research, research.

Learn your real estate market.

A steal of a deal in Los Angeles, CA may not be such an amazing deal in Atlanta, GA.

But if you fail to do your due diligence to learn your market, you won’t know these things.

You should be acutely aware of how much houses are going for in your area based on their square footage, number of bedrooms and bathrooms, condition, and neighborhood.

And you will also need to familiarize yourself with the renting climate of your city so that you will be able to accurately assess what a property can realistically generate in rent.

Other things to maintain an awareness of that will affect your return on investment are:

If you take your time in the beginning, you will minimize investment failure…

Plus give yourself adequate time to learn the industry and create the applicable contracts to safeguard your investments.

You should have a contract for:

While this might seem overwhelming at first, you will get the hang of things faster than you might expect!

And if you’re feeling a little unsure of where to get started…

Try the old fashioned approach of reading up on the subject!

Here is a fantastic article on the 9 best real estate investment books for 2026.

You’ve got this.

Pros and Cons

of starting a real estate business

Pros

The good news here is that real estate investment has a long history of being a sound investment strategy. Real estate is classically one of the few things you can buy that is almost guaranteed to appreciate in value. Yes, recessions happen, and you will have to weather some storms... But in the long run, real estate businesses have a history of investment success.

Some people are convinced that they cannot invest in real estate because they don't have enough money. (Or any money for that matter.) While there is some truth to this... There are options to get started in real estate investing with the goal of passive income regardless of your financial situation. To begin with, you can start out by simply renting out a room in your current home or apartment on Airbnb! Then use the profits to start saving for a more substantial real estate investment down the line. And if you're bold enough, you can even try your hand at real estate wholesaling.

The real estate industry has some of the biggest tax advantages of any other business model out there! This is primarily through deferring capital gains taxes, and writing off everything from home improvements and mortgage interest to property taxes and operational expenses.

For many people, the number one goal of real estate investment is to generate passive income. And even with a single rental home... You can generate some steady cash flow and passive income that can then be re-invested into additional properties to grow your investment portfolio.

Cons

While it is possible to get your foot in the door of real estate investing through a loan from family/friends, or through strategic real estate wholesaling... The reality of this business model requires substantial capital. While there are a plentiful number of online real estate gurus touting the message of starting a real estate empire with zero money in the bank... These are largely unrealistic schemes. Starting a thriving real estate business requires hard work, regardless of your current financial situation. But having a lump sum ready and waiting to launch your real estate investment company can make all the difference.

If you are looking to go from zero to hero in a matter of months... real estate investing probably isn't the business model for you. While I generally believe that there is no such thing as a "get rich quick scheme"... Real estate investing requires a commitment to the long game that many people either don't want, or aren't currently able to commit to.

If you have no background in real estate whatsoever... The learning curve to get started with this business model can be extremely steep. You will need to be familiar with a long list of various legal, financial, and commercial concepts in addition to having a firm grasp on basic investing principles and a basic understanding of home financing. Plus, you need to have an intricate understanding of your local real estate market. It's not for the faint of heart!

Maybe you haven't already caught the drift here... But investing in a real estate business isn't something to take on lightly. This business endeavor will require extensive amounts of your time, energy, and sweat equity before you start seeing the major passive income returns that you are probably hoping for. It's best to know what you're getting yourself into before you borrow all that money, my friend.

Starting a Real Estate Business Can Work, but Lead Gen is Better...

Here's Why:

It would be extremely hard to argue with the fact that starting a real estate business is one of the best strategies out for passive income…

And has been for some time.

Not only is there infinite potential to grow and expand…

But there is also an infinite demand.

Even during recession periods, the world always finds a way to bounce back and do what it does best…

Continue to grow and populate.

Which means that new buildings, apartment complexes, and homes will continue to be a valuable investment for the foreseeable (and potentially infinite) future.

Even a meager portfolio of a few single family rental properties can quickly grow into a sizable amount of monthly passive income that can continue to grow as you reinvest your profits!

However, one of the most major drawbacks to real estate investments is the barrier to entry.

Primarily, the hardest part about getting started in real estate is a lack of money or a lack of knowledge.

Many times, it is both.

And while there are a few ways to wiggle around the barrier of finances and slip through a loophole…

It is extremely difficult to get into real estate investing without significant capital.

But I happen to have a fantastic solution to this problem.

And no, it’s not a fishy scheme of how to leverage other people’s money and somehow become a real estate millionaire overnight without any prior money in your bank account.

Please run far away from these people.

My solution actually comes from my own journey to passive income.

When I left my crappy desk job over six years ago to pursue online business, I could barely pay my bills.

I experimented with business models from affiliate marketing to drop shipping, but local lead generation was what changed my life forever.

In fact, online lead generation took me from bringing in barely 2K per month from my 9-5, to bring in well over 50K per month in passive income in less than five years.

All while helping other small business owners thrive by supplying them with the one thing they needed the most:

New leads for their business.

Local lead generation is like having online real estate.

An online lead generation property is capable of generating passive income practically on auto pilot…

And the best part is that anyone can learn the local lead gen business model.

Including you.

Plus, if you’re still sold on real estate investments…

You will already have a sustainable stream of passive income to fund your real estate empire.

Imagine that.

To learn more about how we can help you get started with local lead generation today, click here to learn more.