Is an ATM business profitable?

How does the ATM business work?

How do I start an ATM business?

All of these questions are valid and important things to know before starting an ATM business in 2021.

I'm Ippei, a master of all things online business, passive income, and local lead generation...

And fortunately for you, I have a whole list of 9 tips for you to get started with your own ATM business empire.

Plus, a detailed financial breakdown of the startup costs and profit potential!

But there is one major fatal flaw with starting an ATM business…

Stick around to the end to find out my take on this ATM kryptonite, and my personal solution.

In 2014, I joined a lead generation coaching program that freed me from my 9-5 in 7 months by building and ranking simple websites that generate leads for local businesses (who give me a sliver to deliver)

After grew my lead gen biz to 7 figures, I branched out to experiment with Amazon FBA (ton of hype around it in 2017)

Let's get into starting an ATM business!

Start Up Costs

While this list is not a comprehensive compilation of every you need to start an ATM business, it provides a snapshot of what you need to add into your business plan.

Total Cost to Start Up:

Average: $16,475

Low: $2,500

High: $30,450

Annual Profits of Established Tutoring Business

According to businessnewsdaily.com, the average annual revenue of this kind of business is: $20,000-$30,000

How to Start an ATM Business

Thinking About Starting an ATM Business? Here's What You Should Know:

ATM’s meet a basic need within society, and can become a profitable business. But to get started, you will need to write a thorough business plan, understand the in’s and out’s of the ATM business, learn more about handling vault cash, and set transaction fees, and find the perfect locations.

1. Write a Business Plan

When you set out to start an ATM business, you need to think about it just like you would any other business model.

Which means that you will need to write a business plan for your new ATM empire, just like you would if you were starting any other entrepreneurial business endeavor.

Planning for success and making strategic decisions for your ATM business will be a major determining factor in whether or not you are able to make ATM’s a worthwhile investment.

Writing a business plan doesn’t have to be complicated, though.

You can get started by asking yourself a few basic questions such as:

Once you have answered these questions, write down your answers and begin putting them into a formal business plan structure.

Most formal business plans range between 30-50 pages long, but if this intimidates you, don’t worry.

The important thing is that you get your business plan on paper.

You can always add to it later if necessary.

Your traditional business plan will include the following basic components:

Basic Things to Include in a Business Plan:

2. Understand the Process

The idea of starting your own ATM business is really appealing.

If you’re an entrepreneur, then you’re in the business of making money, right?

So what better way to make money…

Than with a business entirely centered around money!

But you might find yourself wondering, “how does an ATM business work?”

Essentially, ATM’s make money by charging the customer’s a transaction or convenience fee per transaction.

In short, when you use an ATM, you have to pay money to get money.

But because those fees are usually very small and relatively reasonable, most people don’t mind the fee for the sake of convenience.

When you find yourself in a bind, and really need some cash, a nearby ATM is a God-send.

The profitability for ATM owners however, is in the accumulation of those transaction fees.

If an ATM is well placed, the amount of daily transactions can add up very quickly.

Which means that those transaction fees will start to stack up.

Resulting in several hundred dollars a month for you as the owner, per ATM.

If you amass multiple ATM’s in a variety of strategically selected locations…

You could turn an ATM business into a profitable full time business, or even a comfy passive income side hustle, depending on your goals.

The main factors that come into play when predicting profit for an ATM business are:

3. Processing and Vault Cash

Let’s talk about processing and vault cash.

You will need to familiarize yourself with both of these concepts before launching into buying your first ATM.

Here is a basic definition of both terms:

When choosing an ATM Processor, you will need to take several factors into account.

The most obvious one will be how much they charge per transaction.

You aren’t the only one with skin in the game when it comes to transaction fees.

In addition to the fee you will charge each customer, your processor will also have a transaction fee because they have to make money too.

But finding an ATM processor offering a low transaction fee isn’t the only consideration.

Your processor will be the sole factor in making sure that you get paid!

Which means that making sure that you choose an ATM processor with great customer service and accessibility is equally as important as the fee that they charge.

When it comes to vault cash, you’re going to have a big decision to make.

Do you want to be responsible for restocking your ATMs with new vault cash yourself, or do you want to hire out this responsibility to a third party vault cash management company?

So if you are interested in starting an ATM business that generates passive income…

Being responsible for driving around to each ATM location yourself to restock them might not be the best option.

Not to mention the fact that carrying around large amounts of cash for your restock routes can be risky and stressful.

Using a third party vault cash management company is usually the wisest and most convenient option…

But it will cut into your profits considerably.

Both of these factors are things that you will need to think about and plan for when writing up your business plan.

4. Setting Transaction Fees

One of the great things about owning your own ATMs is that you can set your desired transaction fees.

Within reason of course…

It would be nice to think that you could literally charge whatever you want, but sadly, ATMs function like any other business model.

Which means that if your transaction fees are too high, your customer will probably go elsewhere.

Here is an example of common interchange rates...

Common Interchanges | Swiped / Dipped | Keyed / eCommerce |

|---|---|---|

Basic Credit: | 1.51% + $0.10 | 1.80% + $0.10 |

Signature/Traditional Rewards Credit: | 1.65% + $0.10 | 1.95% + $0.10 |

Preferred Rewards Credit: | 2.10% + $0.10 | 2.10% + $0.10 / 2.40% + $0.10 |

Small Bank (Exempt) Debit: | 0.80% + $0.15 | 1.65% + $0.15 |

Big Bank (Regulated) Debit: | 0.05% + $0.22 | 0.05% + $0.22 |

The goal when setting transaction fees for your ATM is to find a healthy sweet spot between undercharging for the sake of beating out your competitors, and over charging for the sake of profit.

If you are so concerned with a competitive transaction fee that you are no longer making anything substantial off of your ATM…

This is obviously a problem.

In contrast, you will actually lose customers and therefore profit if you set your fees too high…

Even if it’s tempting.

Another thing to keep in mind is that on top of the transaction rate from your ATM processor, and the fee that you set…

There is one last fee to take into consideration.

And that is the venue owner fee.

When you place an ATM on a piece of property that doesn’t belong to you as the ATM owner, the venue owner will probably want a cut of the profit as well.

Which is completely reasonable!

This is something you can negotiate with them personally.

But it’s important to take into account, because the ATM customer won’t see the breakdown of all these numbers.

All they see is the final transaction charge when they go to withdraw money.

So you will need to balance your personal surcharge fee with that of the processor and the agreed upon vendor charge.

This number needs to be reasonable when totaled up as the final amount that your ATM customer will see.

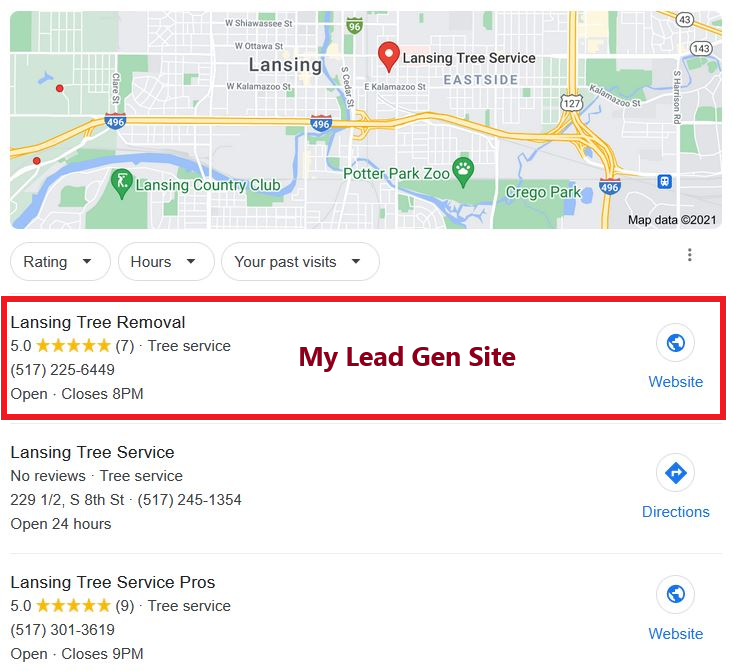

5. Location is Everything

If you are truly serious about building and scaling an ATM business, then there is one thing that will absolutely make or break you.

And that is location.

When looking at the ATM investment opportunity, location is everything.

Just because you find a high traffic area and a vendor willing to allow you to place your ATM on their property…

Doesn’t mean that it’s a good location choice.

In fact, there are a variety of factors that go into finding the perfect location for your ATM.

While having heavy foot traffic is important, there has to be a demand for cash or the amount of traffic really won’t matter.

Some heavy traffic areas that usually have a high demand for cash are:

Great Locations for an ATM:

The key is to find an ideal location that hasn’t already been snapped up by larger ATM deployers.

Sometimes this means that you will have to make compromises and take risks on a location that has potential, but isn’t the top tier “ideal” location.

For example, placing an ATM in a smaller town that will have less traffic, but in an area where there are 24/7 convenience stores might still make for a profitable location.

Trial and error will have to occur during this process, but as you continue to grow and scale your business, you will get the hang of finding an ideal location.

Ultimately, you will have to be prepared with a lead generation strategy that will attract new customers to your business on a consistent basis.

Fortunately we can teach how to do exactly that through our local lead generation coaching program and online course.

6. Cold Calls and Closing Deals

Once you’ve done your due diligence for finding ideal locations for your ATMs, you will need to actually start closing deals with vendors.

Finding vendors is usually done through cold calling.

Once you’ve created your list of ideal locations, find the businesses in those places that would be a good fit for an ATM and just start calling.

When you make a call, explain to the potential vendor why you think an ATM would be successful at their location and place of business, and how they will benefit from having your ATM on their property.

If you place a call only to find out that the business already has an ATM, don’t let that immediately end the conversation!

One of the best ways to create successful vendor relationships is to create an agreement with a vendor who is currently dissatisfied with their ATM supplier.

Many times, ATMs are not well maintained.

Either they are always breaking down, or they are consistently out of cash.

This can be an extremely frustrating problem for the vendor.

If you can offer an alternative through your services, they may be more than happy to ditch their current ATM distributor for your services instead!

Once you’ve got a vendor interested, you can haggle out an agreement on vendor charges.

After that, it all comes down to creating a contract, getting signed, and installing your ATM!

Making sure that you are on top of your ATM maintenance and vault cash restocks is an important part of maintaining healthy relationships with your vendors.

Remember, if you replaced their previous ATM distributor…

They’ll have no problem replacing you if you don’t hold up your end of the bargain!

Operating your ATM business with excellence is crucial.

7. Installation

Installing an ATM isn’t complicated.

There are really only three main components to consider before installing your ATM:

Obviously, before you can place your ATM in its new location, your vendor will need to make space for it.

Make sure that they know the dimensions of your ATM unit, and that they have adequately prepared and measured out space for its placement.

They also need to be warned ahead of time that the ATM will be bolted to the floor to prevent theft.

Ideally, it will actually be bolted directly into concrete.

While having something literally try to run off with an ATM unit isn’t exactly common…

It has happened.

So making taking this preventative measure against theft is mandatory.

When it comes to power, the space chosen by your vendor obviously has to have access to a power source for you to plug the ATM into.

This really shouldn’t be a problem, but it is something that you will need to communicate in advance, just in case.

Finally, your ATM will require a line of communication.

For it to successfully do its job and process transactions, there will have to be one of three communication lines available.

8. Insurance

Lastly, please take into consideration that when running an ATM business, security is extremely important.

You are literally leaving your hard earned cash in public places.

Granted, it’s inside of a vault that is bolted to the floor…

But that doesn’t make your ATM impenetrable.

There are a variety of ways that your ATM could be subject to theft:

All of these scenarios are real possibilities.

Which means that one of the best things you can do for your ATM business is to invest in ATM insurance.

ATM business insurance will cover a variety of scenarios and protect you should the worst come to happen.

Pros and Cons

of starting an ATM business

Pros

Yes, you read that correctly. In theory, you can start a t-shirt business for practically nothing! If you already have creative abilities, you can craft your designs in Canva for free, and start selling them via a print on demand website such as TeeSpring, and market your apparel line via social media without any intensive startup costs. While this route doesn’t exactly guarantee a lucrative result, it is possible to get started this way!

Whether you go the route of manufacturing your t-shirts yourself from start to finish, or you decide to use the print on demand method… you will be able to run this business from your home! So if you’re looking for a side hustle or business model that will enable you to ditch your commute… Starting a t-shirt business can be a great option for you! If you do decide to print your t-shirts at home, you will simply need to designate a room, or a corner of a room, as your manufacturing area!

I really cannot express how easy print on demand makes starting your own clothing line. It truly is an ingenious way to start making some extra money, without fully investing in an entire screen printing operation out of your home! Plus, once your designs are uploaded, you can start bringing in passive income as your t-shirts sell and are shipped out to your customers without you lifting another finger. Magic!

Cons

While there are some amazing benefits to selling t-shirts...There are some downsides as well. The high demand for t-shirts makes this industry appealing to many many people, which has resulted in a heavily saturated online market for t-shirt sales. This can make breaking into the apparel market difficult at first. Especially if you haven’t done sufficient market research to determine what will sell, and where there is a sweet spot between what’s trending, and your own unique designs.

For many people, the benefits of the print on demand model far outweigh the cons. After all, it does streamline the entire process of selling a physical product! But it has one major downside… Your profit margins. When selling your t-shirts via a print on demand website, you might be lucky to walk away with 30% of your total sale. Granted, you aren’t doing the tail end of the work to manufacture and ship your item, but you do need to recognize that you will have a minimized potential for profit if you go this route.

On the flip side of things, doing it yourself can increase your profits… But that comes with an added level of risk. If you are going to be manufacturing your t-shirts yourself, you will need to invest in much more equipment, which increases your initial investment, and prolongs your ROI. Plus, you will need to order your blank t-shirts in bulk before you’ve accepted your first sale! And if you haven’t properly marketed your business, this can be a risky move.

Starting an ATM Business Can Be Profitable, But Lead Generation is Better, Here’s Why:

Let’s talk good news and bad news.

So the good news here is that there is a potential to make a good amount of money through running an ATM business.

And if you do it right, it can grow to be a steady stream of passive income.

But the bad news…

Is that experts are predicting that ATM’s will be extinct by 2037.

Which means that if you choose to invest into an ATM business in 2021, you have less than sixteen years life expectancy for your business.

Especially if you consider the fact that they won’t be going extinct overnight.

Because of the digital age that we are living in, the need for cash and ATM’s is already starting to visibly fade.

The progressive decline of your business’s profitability is almost guaranteed.

But if you’re interested in starting an ATM business for passive income, then you probably are more interested in the passive income part than the ATM part, am I right?

If so, then I have some more good news for you.

I have a much better option for a passive income business model than ATM’s!

Plus, my business model has an extremely long, if not infinite life expectancy and sustainability.

What is the magical unicorn of a passive income business model?

Lead Generation.

Local lead generation has completely changed the way that I look at passive, and it took me from making only 2K a month at my previous job, to bringing in well over 50K a month.

The reason that using Google and SEO to create multiple lead generation properties online is so sustainable is because small businesses will always need more leads.

Think about it.

No matter what industry you’re in, the only thing that makes your business successful is having customers!

Which means that having a steady stream of quality new leads is a virtually unmatched commodity for business owners.

If this is piquing your interest…

Take a look at how we can help you get started with local lead generation today.