So you’re great at math, and you’ve always wanted to work for yourself.

Plus, helping other small businesses to grow and thrive sounds like something you’d love to do!

You might just have what it takes to be a bookkeeper.

But you’ve got some questions.

Can I start a bookkeeping business?

Is a bookkeeping business profitable?

How do you become a certified bookkeeper?

What software do bookkeepers need?

And can you start a bookkeeping business from home?

Don’t worry…

I’ve got you covered.

My name's Ippei, and I'm basically a master of all things online business, passive income, and local lead generation.

And not only will I go over all the startup costs and revenue potential for a bookkeeping company…

But I’m also going to take you through my nine step quick-start checklist that is filled with helpful tips, to get you headed in the right direction.

As well as the key pros and cons to a bookkeeping startup.

Plus, you’ll want to stick around to the end to find out what I think is an even better alternative to starting your own bookkeeping business.

But enough explaining…

Let's get into starting a bookkeeping business!

How to Start

Bookkeeping Business in 2021

Start a Bookkeeping Business Summary

Starting a bookkeeping business is an affordable and fulfilling business model. You can work remotely, and help other small businesses to grow and thrive! To get started, you will need to create a business plan, purchase insurance, invest in your equipment and certification, and find your bookkeeping niche.

Start Up Costs

While this list is not a comprehensive compilation of everything you need to start a bookkeeping business, it at least provides a snapshot of what you need to add into your business plan.

Annual Revenue of Established Bookkeeping Business

According to Success Tax Professionals, the average annual revenue of this kind of business is:

Profit Margins of Established Bookkeeping Business

According to CPA Innovations, the average profit margin of this kind of business is:

Quick Start Checklist:

1. Write Business Plan

Starting a bookkeeping business should start off on the same strong foundation that any new business venture would.

Even if you’ve worked as a CPA, accountant, or bookkeeper before.

Which means you need a solid business plan before you can move forward.

Most likely, writing a business plan for your bookkeeping business will primarily be for you.

Business plans have two purposes:

Starting a bookkeeping business is a relatively affordable business venture, so obtaining external funding probably won’t be applicable or necessary for you.

So writing your business plan will serve the purpose of getting you started on the right track, and keeping you focused on your long term business goals along the way.

When writing a business plan, you should include these basic components:

6 Basic Components to a Great Business Plan:

Your executive summary is a basic overview of what your business does and how it operates.

It should also include your mission and vision statement.

Writing your company description is taking the executive summary and adding more complexity and depth.

Include detailed information on who your business will serve and how you will solve their problems…

As well as all the information you have on how you intend to operate your business.

Writing a market analysis is an important step.

While every business needs a bookkeeper, it’s still important to know the lay of the land in the industry you’re breaking into.

As well as scoping out what your competitive advantage might be.

For your organization and management section, break down how your business will be structured behind the scenes.

And for your marketing and sales section, detail your plans to successfully attract and close new clients.

Finally, you’ll want to include financial projections for the next year to ten years of your business.

These financial projections should be challenging but realistic goals for the success of your business.

2. Getting Legal and Business Insurance

Now that you have your business plan fleshed out and squared away, it’s time to get your business legal and ready to start operating!

I highly encourage you not to skip this step, or “come back to it later”.

Before your business has made a single penny, you need to make sure that you are legally allowed to operate and file taxes.

As someone in the bookkeeping industry, you should know better than anyone how many problems occur when a small business owner fails to properly structure their business on the back end.

Talk about a headache!

You will probably want to establish an LLC for your bookkeeping company to start out.

From there, you should also look into general liability insurance for yourself as a bookkeeper.

It might not seem like a necessary expense starting out…

But trust me.

On the off chance that something goes wrong and a client decides to sue you…

Having general liability insurance as a bookkeeper could save you thousands upon thousands of dollars.

It’ll be well worth the $30-$50 a month that it might cost you.

3. Necessary Skills and Equipment

If you are considering starting your own bookkeeping business, you might be wondering what skills, requirements, and equipment you will need to get started.

Especially if you don’t have a background in finances or accounting.

The good news is that becoming a bookkeeper has very minimal legal requirements!

Although an associate or bachelor’s degree in accounting might be helpful, the only legal requirement is a high school diploma.

The most important thing is an aptitude for the job itself.

Bookkeepers need to be extremely organized, and competent in administrative tasks.

You should also keep in mind that although computers, spreadsheets, and calculators will be your best friend in this job…

A solid grasp of mathematics and a love of numbers will also be a must.

If you want an extra level of training that will boost your credibility with potential clients…

You can also invest in a bookkeeping certification.

These courses are very affordable, and the certified public bookkeeper exam itself only costs between $100-$150.

Beyond these basic levels of competence and job aptitude, you will want to master these basic skills before taking on your first clients:

Your equipment list is also quite simple!

The main things you’ll want to have are a computer, a high speed internet connection, cloud based accounting technology, and a website.

From there, you’re ready to start crunching numbers and helping small businesses.

Which is basically the best part of being a bookkeeper!

Most business owners dread the bookkeeping and administrative side of their jobs…

If you can competently take this off of their hands, and maybe even save them some money come tax time…

They’ll probably shed tears of joy and hug your neck.

4. Niching Down and Ideal Clients

Although you can launch a bookkeeping business without choosing a niche…

There are a lot of advantages to knowing who your ideal client is, and what niche they fall into.

Finding a niche for your bookkeeping services gives you a unique advantage over other generic bookkeepers, and allows you to market your services more strategically.

In theory, your ideal client and niche could be in practically any area.

But I recommend choosing a business niche that you are passionate about, or one that you already know a lot about.

Maybe you worked in the restaurant and food service industry for a long time, so you understand the potential pitfalls and pain points of restaurant owners.

Or perhaps you are really passionate about helping non-profits organizations succeed.

You could also take a more generic approach to niching down, and target small business owners that struggle with handling their books on their own, but don’t think they can afford a bookkeeper.

Whatever your niche is, just make sure that you think long and hard about who your ideal client will be, and what they will need.

Discovering the pain points of the business owners you will be serving is the key to a successful bookkeeping business.

Because the unique pain points of your ideal customers will determine the way that you speak to them, and the language you use throughout your website and your marketing materials.

Find your client's pain points, solve them with excellence, and serve them with consistent value.

If you do this well, your clients will rave about you, and the referrals will start streaming in like you wouldn’t believe.

5. Services, Prices, and Packages

Now that you know your niche and your ideal customer, you can establish your list of services and your pricing structure.

One of the biggest reasons that small businesses take on their own bookkeeping is that they feel they can’t afford to hire a professional.

Which means that having clear communication regarding your pricing and packages will be crucial.

Find ways to streamline your pricing so that you offer your services as if they were a product.

Most business owners don’t know how many hours they will need a bookkeeper for.

So having an hourly rate list on your website can be confusing and frustrating.

Most people will want to know what services you can offer them on a monthly basis for what price tag.

My recommendation would be to structure your business pricing in 3-4 different packages.

Think “bronze, silver, and gold” package structures.

Here is a table view of a popular online bookkeeping businesses (Bench.co) packaging and pricing.

Client's Avg. Monthly Expenses:

Annual Price:

(Includes a Discount)

Monthly Price:

Starter:

$0 - $3k

$1,908

$189/mo

Micro:

$3k - $20k

$2,388

$219/mo

Boutique:

$20k - $50k

$2,988

$279/mo

Venture:

$50k - $100k

$3,588

$359/mo

Corporate:

$100k - $1M

$5,028

$499/mo

Depending on what your potential client can afford, and how much help they need each month, will determine the package that they choose.

Here is a basic list of potential bookkeeping services that you can offer to your prospective clients in various packages:

Keep in mind that when you price out your various packages, you will need to be realistic about your personal time commitment.

Don’t make the mistake of short changing yourself because you underestimated the amount of work involved with the services you’ve offered.

6. Website

Much of the work that you will do as a bookkeeper can be done remotely, or even from home.

Having a personal office isn’t absolutely necessary.

Although having an office space to use for your business and meet with clients can be helpful, you can do this job from your home when starting out.

With that being said, your website will be the face of your business.

Which means you want it to be a professional and inviting reflection of the business you’re running.

Don’t skimp on your website when this is probably going to be your first level of contact and interaction with your potential clients.

Clearly communicate who you are and who you serve.

Refer to your business plan during the planning of your website, and include key details like your mission and vision statement, and portions of your business description on your site.

If you have the funds, you can choose to hire a graphic designer to help you create your website and even a company logo for your bookkeeping business.

But if you choose to build the website yourself…

Don’t be nervous!

There are some great template based website builders available now that make creating your website yourself extremely simple.

Plus they look great too!

Here are a few of my favorites:

Whether you choose to hire a graphic designer, or build out your website yourself using a template website builder…

Include these main pages:

Despite the fact that the majority of your bookkeeping job will be working remotely…

Most people still want to know who they are working with.

So your Home Page should include a professional but personable photo of you, and your About Page should be focused on who you are, your skills, and why you do what you do.

These pages are all about showcasing who you are, why people should work with you, and building trust and credibility.

Then, when they move on to your pricing and packages, they will already feel more confident about hiring you.

Keep your contact page simple and straightforward.

The goal is to establish contact with a potential lead, give them a quote or breakdown of your packages, and ideally schedule an initial phone call with them.

Include a basic questionnaire that goes over their business type and their needs, as well as their budget for bookkeeping.

7. Blogging

The last page you should include on your website is a blog.

Why the heck do you as a bookkeeper need a blog you ask?

Well, while you don’t necessarily need to become a full time blogger to have a successful bookkeeping business…

Having an established and active blog on your website can help your bookkeeping business immensely.

First of all, your blog is a platform that will allow you to gain trust, build credibility, and establish yourself as an expert in your field.

It also allows you to provide value to potential clients before they’ve even hired you.

People are much more inclined to do business with someone they don’t know if they trust you.

And one of the best ways to build trust is to help solve their problems and provide value to them before they’ve paid you for anything.

Now, I’m not suggesting that you have to go and give away all your bookkeeping secrets of the trade for free!

By no means.

Possible Article Titles:

These types of blog posts will show people that you are passionate about what you do, and that you value helping businesses succeed.

Plus, they will help your website’s SEO tremendously, and drive fresh traffic to your website.

And you know what that means…

More new clients!

Consider setting up a blog when you launch your website, and set up a posting schedule for yourself.

If you can’t write a blog post once a week, even 1-2 posts a month will help your website start to rank higher in Google and hopefully get more eyes on your contact page.

8. Marketing

Your website and consistent blogging shouldn’t be your only method of marketing for your bookkeeping business!

Just as with any other business model, being a bookkeeper will require you to market yourself.

Which means that you need to set up social media accounts on a variety of platforms, as well as starting an email list for your business.

Growing your email list can easily be done through creating a pop-up window on your website.

This will be especially useful on your blog.

Most people won’t want to give their email away to some random bookkeeping website.

But if they’ve found value from one of your blog posts, and are interested in the content you are putting out, they will be more open to signing up for your email list.

You can further entice people to sign up by offering them a free PDF guide of some sort.

Make it something helpful and applicable to your ideal client.

Like a free guide to preparing invoices, or a guide to simple business tax deductions.

Once you have their email, you will be able to further market your services to them, as well as continuing to build trust and provide value.

Your blog, email list, and social media accounts can all be interconnected.

So when you write a new blog post, share that on your social media accounts, and send out an email to your subscribers!

My #1 recommendation for local businesses???

My #1 Recommendation for Bookkeepers???

Learning the skills to set up systems to generate your own leads virtually on-demand. It's called Lead Generation, and it is a skill that I have honed over the past several years. It's allowed me to help generate local businesses hundreds of millions of dollars in new business opportunities, and anyone can learn how to do it.

In addition to these digital marketing techniques…

There’s something to be said for some good old fashioned in person networking.

Get involved in your neighborhood business community by joining your local chamber of commerce!

Basically everyone who is represented in your local chamber could be a potential client…

Because they’re probably a small business owner!

Showing up at your local chamber of commerce meetings…

And establishing your presence as a bookkeeper passionate about seeing small businesses thrive is sure to drive a ton of business your way!

9. Vetting Potential Clients

Lastly…

Don’t forget to vet your clients.

What do i mean by that?

Essentially…

You don’t want to work with anyone who comes knocking at your door.

While it might be tempting to take on any and every potential client that comes your way…

I don’t recommend doing this.

If you are so eager to get business that you take on nightmare clients who drain you of your time and enjoyment of your business…

You’re going to get burnt out and frustrated.

Overly needy clients, or clients who fail to provide you with the information you need to do your job are extremely common in the bookkeeping arena.

If they are going to be the type of client who is constantly calling you at all hours of the day (and night), or if they are going to constantly forget to turn in reports or hand over receipts…

You don’t want them as a client!

Having an initial phone call or meeting with business owners before you commit to taking them on as a new client can spare you a lot of stress and headaches in the future.

As you become more experienced, you will learn how to spot the read flags when onboarding a new business owner as a client.

Which will ultimately ensure that you not only enjoy what you do, but that you are better able to serve the clients that you do love!

Pros and Cons

of starting a bookkeeping business

Pros

For many aspiring entrepreneurs, one of the greatest draws to launching a business is the freedom to set your own schedule. There’s no boss to dictate your day, or look over your shoulder… You are in control of your time. This can be both freeing, and stressful. But for most small business owners, it is one of the most gratifying aspects of being self employed.

Ultimately, a bookkeeping business requires minimal tools, supplies, and software. In comparison to the average upfront investment required for most businesses… A bookkeeping business has very low startup costs. This is good news for someone who is ready to put in the time and effort that it takes to run their own business, but don’t have a lot of capital to invest initially.

Possibly one of the most satisfying aspects about running a bookkeeping business is that you will be able to use your skills to help other small businesses to grow and thrive. You aren’t just creating an income for yourself and your family, you are aiding other business owners who are trying to do the same. The work of a bookkeeper is extremely valuable, and your job will help take tremendous stress off of others who don’t possess your skills.

Cons

Unfortunately, bookkeeping isn’t exactly a high paying gig. While you can definitely land a few high paying clients, the average business owner can’t afford to pay copious amounts of money on bookkeeping. If you price your services too high, many prospective clients will simply DIY their books, or invest in an online software to do it for them rather than a personal bookkeeper.

Your income as a bookkeeper will be directly tied to the hours that you work. It isn’t a source of passive income. So if you’re leaving your 9-5 in hopes of working less… You may need to reframe your expectations.

Bookkeeping isn’t the type of job that anyone and everyone will be cut out for. It requires someone who has the aptitude or pre-existing skills in the areas of math and administration. Being organized and good with numbers isn’t optional. If you know these things aren’t your strong suit… It’s best to find a different business model that will play to your strengths. You will be handling other business owners’ books, and this isn’t something to take lightly.

Starting a Bookkeeping Business Can Be Profitable, But Lead Generation is Better, Here's Why:

In case you haven’t picked up on this just yet…

Starting a bookkeeping business isn’t exactly a get rich quick scheme.

Which in all honesty…

Those don’t exist.

But in the case of bookkeeping, you should be prepared for long hours, and a relatively low return for your sweat equity.

The average annual take home pay for a bookkeeping business comes in at under $50,000.

Now, 50K a year isn’t exactly a salary to turn your nose up at.

But I’ll tell you a secret…

I went from making 2K a month to 54K a month in less than five years.

Yes, you read that correctly.

My monthly income is more than the average bookkeeper’s yearly income.

How is that possible?

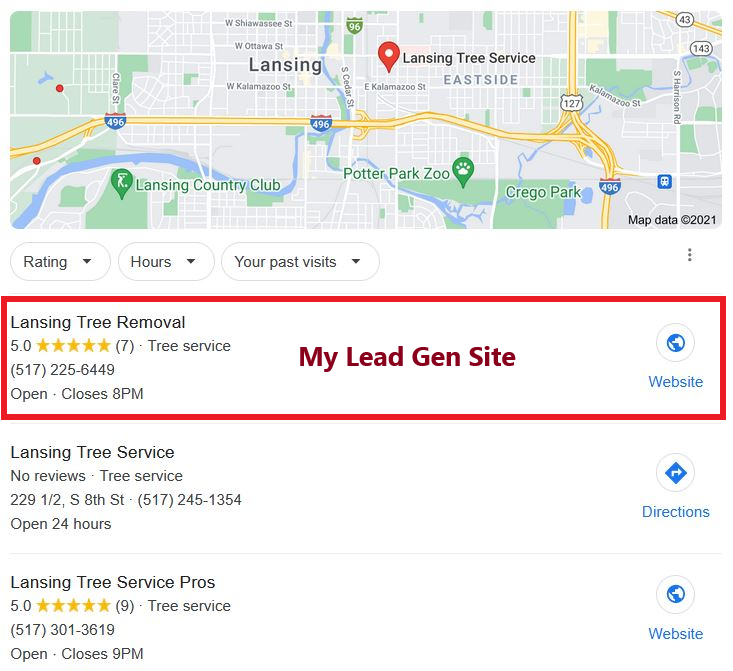

Because I poured my energy into establishing a passively generated online income through local lead generation.

So if you’re interested in ditching a desk job of full time bookkeeping and creating a sustainable passive income stream…

I have good news for you.

Anyone can get started with lead generation…

Because local lead generation is simply a set of skills used to generate new leads for other small businesses through effective SEO strategies and Google.

If you’re interested in bookkeeping, chances are it’s because you’re interested in helping other small business owners succeed.

Local lead generation does exactly that, because the one thing small business owners always need more of is leads.

Click here to learn more about how we can help you get started with online lead generation.